Budget falls short on raises, includes bonuses for employees & retirees

Jun 28, 2016

The General Assembly announced last night its compromise on the state budget for the coming year, and the news is a mixed bag for state employees and retirees that stops well short of fully addressing the fact that we keep falling further behind each year.

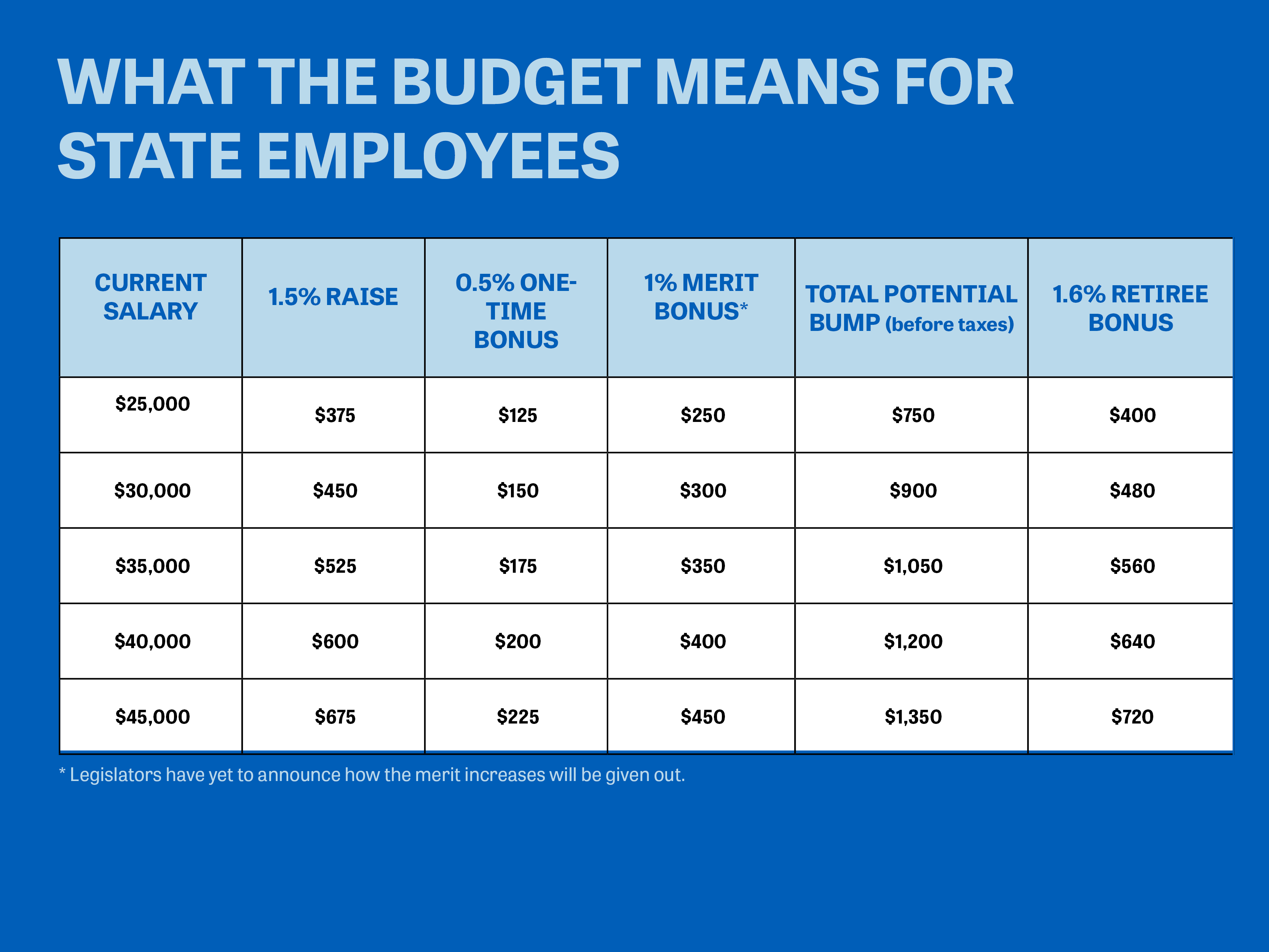

Legislators proclaimed that the budget includes a 3-percent state employee raise, but that’s a stretch. The deal includes a 1.5-percent salary increase for all state employees along with a .5-percent one-time bonus. Another $80 million has been set aside for targeted merit one-time bonuses, which equals around 1 percent of salaries as well.

The fact in that equation is that state employee pay checks are only guaranteed to increase by 1.5-percent in this deal. When compared to the rising cost-of-living, along with increases to the employee costs associated with the State Health Plan, state employees are sure to have even less buying power next year than they did this year.

Legislators have also failed to lay out exactly how the merit bonuses will be awarded. The Senate budget left that decision up to agency heads, which usually means that their favorite employees get all the money and rank-and-file employees, who are hurting the most, get little to nothing.

The budget is even worse for retirees. Rather than a true cost-of-living adjustment, legislators decided on a one-time bonus of 1.6-percent. For the average retiree receiving $25,000 annually from the system, the bonus will amount to around $400, before taxes are taken out.

Retirees will receive no recurring increase on their pension checks. Coming into 2016, retirees were down 10.5-percent to the Consumer Price Index since 2010. This budget ensures they will fall even further behind once again.

Legislators who opposed retirees in the debate pointed to what they called an “unfunded liability” of nearly $700 million. This was a grossly inaccurate statement that obviously conferees chose to believe. The “liability” claim would only hold true if the state never planned to put the employer contribution in the system again for the next 12 years. If that happened, the state would have much bigger problems than just an “unfunded liability.” It would have no workers at all.

The Senate and House will begin voting on the budget this afternoon and are expected to pass it with little debate. Legislators didn’t make your needs a priority in June, and we expect that you will make voting for them even less of a priority in November.